Banana Stand Launch: I made $1 Through Automated Algorithmic Trading and it feels GREAT

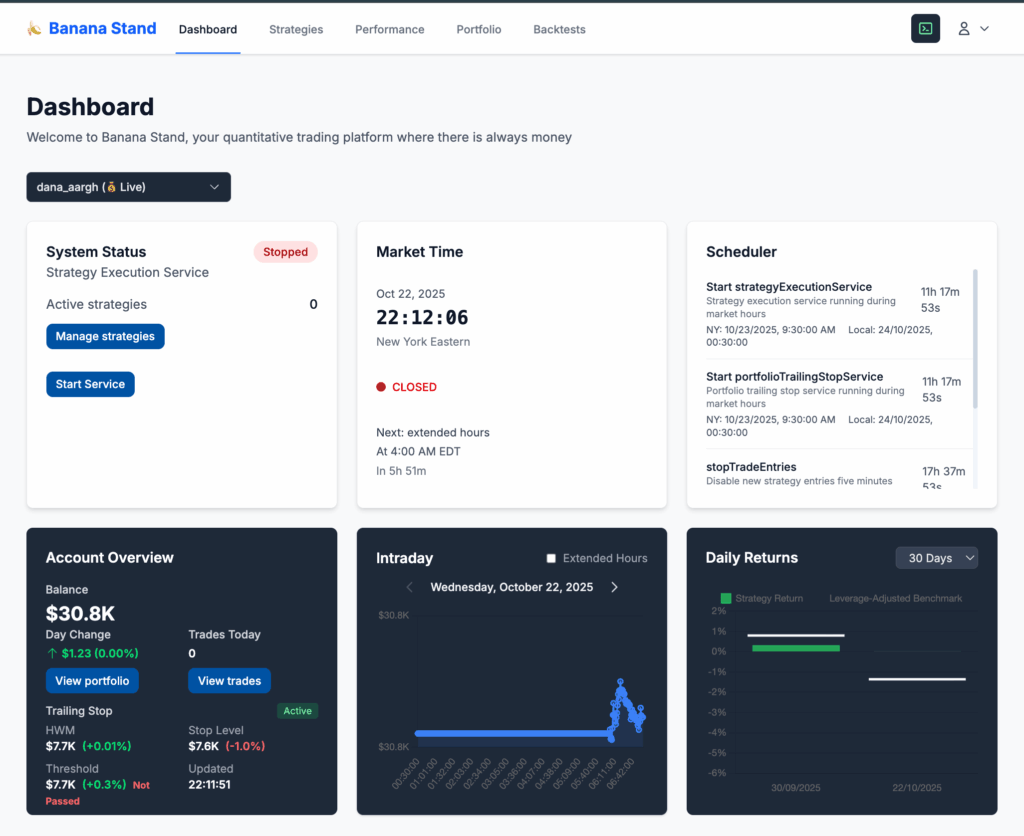

I did it! I went live with my platform, Banana Stand (not open to the public… yet, though maybe not ever, due to regulatory constraints, and the fact that I’d have to update my APIs), in no small part due to encouragement from friends and family, in spite of my internal obstacles. (Thank you, people involved.)

And on day one, I made a dollar. Actually, at its peak, I made three dollars!

This sounds ridiculous. Who cares about a dollar, or three? I do. Because it took a long time to get here.

Back up… Banana Stand? Algorithmic Trading? Banana Stand?

There’s always money in the banana stand.

That’s the theory, anyway. Trading and algo trading work for some. I’m better than some. I can make it work for me.

So for the last six months, I’ve been working on automated algorithmic trading. Not just the algorithm execution — but automated strategy creation, testing, and refinement, too. The whole pipeline from money in to profits (hopefully) out.

It started out as a hypothesis my former business partner, Mehran Granfar, had that AI (or LLMs) would be better at trading than humans were because AI:

- Can process tons of data faster than humans can,

- Doesn’t sleep

- Makes emotionless decisions

He said he had some early success trading using AI (which I never saw), but the token costs were too high. On the back of this claim, we iterated over AI-powered trading approaches for around six months.

We tried using AI for all the research and decision making. This meant downloading a bunch of data, processing it, and making a trading decision.

There’s merit to this approach, and I’m sure people are following it. But the problem I realised was that while an LLM is very good at processing text data, it’s not great at processing numbers. It’s just not what it’s designed for.

Sure, an LLM can look for broad patterns. And the latest iterations of tools like the internal computation in OpenAI’s Responses API, or other equivalents provided through MCP servers, can do calculations and interpret those.

But the problem is that AI keeps reinventing the wheel. Every single time I give an LLM a bunch of price data, it has to decide what calculations it’ll do and how to prioritise them. Every time, there’d be a ton of overlap with previous times, but it would also be a bit different. I hated the variability because it was impossible to backtest, it was repetitive, and it was expensive.

There are other ways of getting LLMs to interpret trading information — e.g. doing pre-calculations and then describing the data to the LLM. But then I felt the style of precalculation was just guiding the LLM’s response.

The second problem was that I really don’t like using AI as a decision-making engine. It’s unpredictable. In the same way that an LLM can hallucinate facts, it can also make decisions that sound good but have such wide variance that they’re unreliable.

On top of that, AI is slow. Scalping trading decisions need to be made in seconds — or much faster if you’re doing high-frequency stuff. AI and LLMs take minutes. Precious minutes! The stock might have moved by 0.2% or more in that time.

So my system evolved to use less and less AI. It’s now a research-driven algorithm of algorithms — a process for coming up with reliable trading strategies that have reasonable predictive power.

Mehran has continued (I believe) iterating with the AI hypothesis, but I lost faith in that approach.

Can’t You Use Some Other Platform? Quit boiling the ocean

Sure, I could, but I won’t, and you can’t make me, just like I can’t make you use this one. (Nor can I let you.)

There are many reasons why I can’t use other algorithmic trading platforms, and they’re all good!

Firstly, I’m a stubborn bastard. I can do it better, I irrationally believe. It might take me a while, but I can do it. This was part of the fun. I had time and LLMs to help me code, so, why not?

Secondly, I am a cheapskate. I don’t want to pay (minimum) $200 a month for someone else’s platform when I know it’s just software on top of a $100/month API. I’ll just have the API, thanks, and have my merry way with it! Oh, and I’m definitely not revenue sharing with some jerk.

Thirdly, I want more flexibility. I want to be able to swap in other brokers, other data sources, and other indicators. I want to try using AI, even if that is a bit of a wank and has proven unsuccessful. It’s fun!

Fourthly, frankly, I don’t trust other platforms to do a good job. When my platform fails, it’s my bug. I can take ownership of that. But I don’t want to get stuck in someone else’s outsourced customer service system.

So, no, I can’t use someone else’s platform. I want it all!

To Predict the Future, You Must First Predict the Past

Here’s a little insight into how hard it was to launch: it was really hard to predict the past.

No, I’m not talking about backtesting, which obviously you have to do in algorithmic trading. By “predict the past”, I mean you have to be able to explain what your system did while it was live, and why.

Let me explain. In theory, I’d have a bunch of algorithms that would execute during market hours. I’d generally expect something like 20-50 trades, for example, and returns roughly between -1.0 and +2.0%.

Then I’d let the system run over the market hours and do its thing. It would indeed execute its trades and turn a profit or loss.

But after market hours, I have to look at the strategies and say: which ones actually performed well in reality and why? And in order to do this, I have to know:

- Was the strategy good or bad?

- Was the data good or bad?

- Was the execution good or bad?

The problem was that for months, my live execution over a day wouldn’t match my backtesting over the same day. In other words, when I ran my backtester over the same period — the previous trading day — I’d get markedly different results.

The reasons for this were a seemingly endless list of bugs (like technical analysis calculations), incorrect assumptions (like slippage), or implementation of rules (like not respecting trading windows). It took me months to sort it out.

Backtesting will never look EXACTLY the same as live trading, even over the same period and using the same data source, for these reasons (and others):

- Live trading has stop-loss/take-profit which is done to the fraction of a second on the platform, but only every minute when backtesting.

- Fills are assumed when backtesting.

- Slippage is hard to model exactly, and there are always a few data discrepancies between backtesting and reality, just as there are between paper trading and live trading.

Despite these obstacles, you can get very, very close.

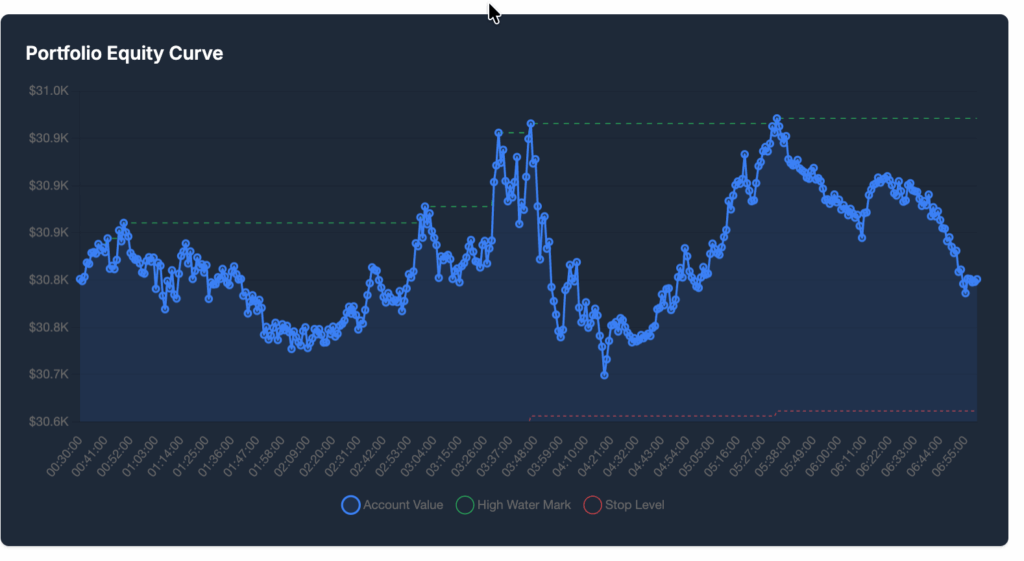

So it was with not a small amount of rejoicing when I finally got a day of live trading to match up with backtesting over the same period.

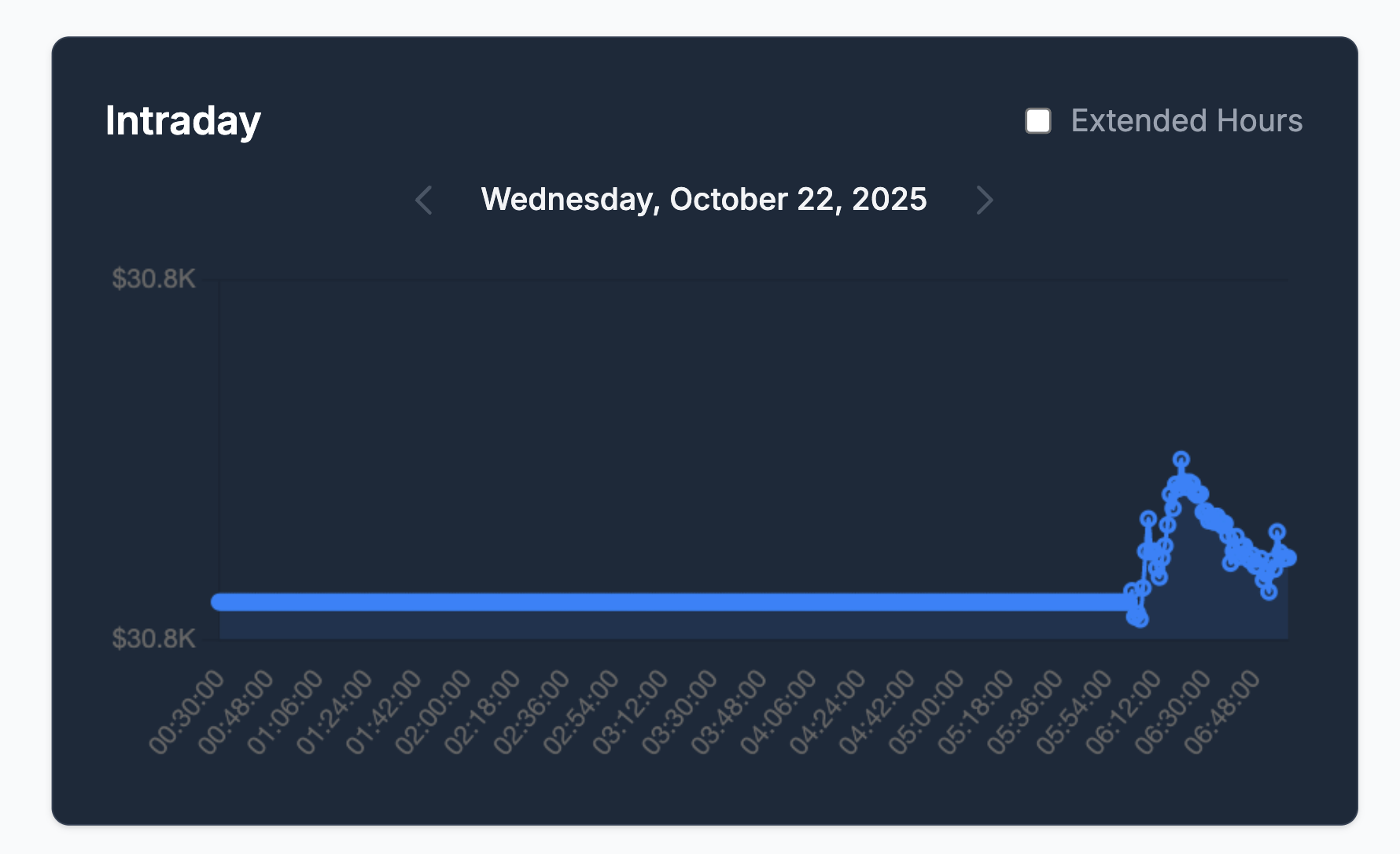

Sorry the charts are slightly different formats. They came from different parts of the application. But you get the idea! The curves have the same shapes and roughly the same proportions. Digging into the trades, they’re also the same, give or take a minute here or there.

Does Algorithmic Trading Mean Predicting the Future?

No! You can’t predict future performance based on past performance! People keep asking me this. Trying is a fool’s errand.

The best way to describe this system is that I can have a reasonable expectation of future performance, within a range of parameters.

Just because a strategy backtests to show a 60% win rate and an average of 0.05% profit per trade, one can’t assume that’ll continue into the future, or occur in any predictable way.

But the general theory behind Banana Stand is that every strategy works sometimes, on some equities. The key is figuring out which and when, and determining when they’ve stopped working. EMA crossovers work for some assets on some people, so why not on the ones I’m testing, and why not for me?

To help me believe it might happen, I did what’s known as walk-forward testing of my system. This means I took a point in time — like, a week ago — and generated strategies for that point. Then, I simulated those strategies over the upcoming week (which was the past week). If the system performed similarly in the upcoming week as they did in the backtest period, then I could reasonably assume my system would work for any point in time.

Of course, there’s an important caveat: regime changes. A strategy can stop working at any particular point in time if the market changes in nature. A company might do something crazy, a certain US president may tweet something bonkers, or some other externality might change things. You don’t know. I’m not controlling for that yet, but I’ll have to, soon.

What’s Next?

I’m trading on a small portfolio of $7.5K right now. I’ll scale that up in the coming weeks, as I see how it performs. But the future is bright, now that I’ve finally launched.

Will I open it up to others? Possibly, but there are a few things I’d have to do first, to make sure other users have a rock-solid experience. I’d need a lot of testing, security, insurance, and customer service.

But mostly, I’m interested in observing the system’s performance in a live environment in the coming months. So far, so good.