Jeff Anderson Buyer’s Agent Review — Unabashed Praise

Ask the public — e.g. your friends, my Dad (who has been doing this for a while and has opinions on things), or the internet on Reddit in r/AusProperty — and there will be generally two schools of thought about buyer’s1 agents, also known as buyer’s advocates.

The first is that some are good, and some are bad — but that the bad outnumber the good, and you certainly don’t need someone. The second, often quite vocal opinion, is that they’re a waste of money and they add nothing other than taking another 1% off your transaction price.

But anyone who has been up against a buyer’s agent knows that they can be a formidable force. And those who have worked with a good buyer’s agent know what it’s like and wouldn’t hesitate to work with one again. This is us!

This is a review of Jeff Anderson (link to his site), a buyer’s agent we’ve been pleased to work with in buying two properties — maybe more — and it’s one of unabashed praise. In working with him we’ve been agog at the range of strategies he’s used to bring a sense of order into what can be a chaotic process, and all for a very reasonable fee.

For once, working with Jeff, rather than feel manipulated by real estate agents, at the whims of sellers, and victims of a market we didn’t understand, we felt like the cards were in our hands — at least, all the cards possible.

If you’re hesitating as to whether or not contact Jeff: don’t. In a nutshell, I recommend him because

- He has a “cash-only” (no commission) pricing tier that would suit a lot of younger buyers

- He does all the talking to agents for you and gets them to say things they wouldn’t tell others (e.g. what the reserve price is, what the sellers will accept in terms of an offer)

- He’ll give a no-frills opinion on suburbs and properties to look at that’s backed by a lot of nous (which is informed by data and personal experience).

Anyway, here’s more below.

You might also like my review of what it’s like to live in Melbourne. Just some unedited thoughts!

About Us as Buyers (for context)

Every buyer is different. Maybe you’ve bought and sold a dozen houses, or maybe this is your first. Either way, this is a bit about us, just for context, to see if you relate.

We’re both “smart” people, you could say, but generally not salespeople types. I’m not afraid of bartering where I feel like it’s safe and expected. I’ve bought and sold dozens of vehicles and negotiated the purchase and sale of online businesses through brokers, but it’s always done in a fairly controlled manner in an environment with rules.

In terms of property, I’m a relative noob. Before I started buying property with Jeff, I had previously owned an apartment (which I bought through another agent I don’t recommend, not for a negative experience, but the absence of an exceedingly positive one — I don’t recommend any other agents, to be clear).

I’ve also previously bought and sold websites (online businesses) but for relatively small sums of under $100K.

In the past, I’ve helped other people with transactional due diligence for huge companies, worked in finance on transactions exceeding $100M, and I help people buy online assets — online businesses including websites, marketplaces, and e-commerce businesses.

Because I know that my experience can help others with difficult transactions, I recognised that someone like Jeff could help me.

Why a buyer’s agent? Many people would quickly say that a buyer’s agent’s interest is only in themselves. There’s some truth to this.

But the reason I believe in buyer’s agents is that in every transaction, both sides need an advocate. I wouldn’t represent myself in court against a team of lawyers. When companies do takeovers, the buyer and seller each have investment bankers and lawyers.

When selling a property, the agent takes probably too big a slice — I believe each side should take 1%. But having advocacy is something that makes sense in an unfamiliar market, particularly when the other side has one.

In the US, the buyer and seller each have a “realtor”. This is standard practice. The buyer’s realtor is what Australians call a buyer’s agent.

What Makes Jeff Special

If you schedule a call with Jeff, he’ll give you his background. He’s a salesperson. In brief, he worked in real estate for decades, running offices and even companies. He offices for various real estate agents, was a top-ranked auctioneer in Victoria, and was CEO at Woodards. (See more about him here on his own site.)

But that’s not all. I think two main things make Jeff special as a buyer’s agent:

- Cash-only options in the pricing structure

- Accessibility even for budget transactions

Firstly, the cash-only option. Jeff offers a few tiers of pricing. You can pay him a per cent commission, in which case he’ll do a lot of hunting for you of properties based on leads that he has. (When you’ve been in real estate forever, you have emails in your inbox constantly for opportunities before they go on the market.) But you can also just pay him cash if you’re going to do most of the legwork.

When we engaged him, in 2023, there was a cash-only option of $3,000. With cash-only, you still get an awful lot, including

- His opinion of a property’s potential based on its characteristics, suburb, and features — he’ll flat out tell you if one shouldn’t be considered, but get all excited when one should be. He also gets a report generated for you, and does an estimate of its value based on comparables in the area. (He does this 12-15 times, he says, but in reality, most people don’t need anywhere near that many… you can only focus on one or two properties at a time!)

- Engagement with the real estate agent on your behalf. Real estate agents use all kinds of tactics to get more money out of buyers, including asking questions that seem innocuous. I learned a lot about this. (It might be obvious to you, but for example, I never tell an agent now that I’m going to bid at auction. I’m constantly shocked now when I hear people tell agents they’re going to “bid hard” or tell them what their budget is. You’re just handing them money!)

- Bidding at auction. The jury’s out as to whether this has an effect. But if you’re a nervous type, then it really helps. Personally, my heart was in my throat at the auctions I attended at which I was bidding, so it was helpful to have him there. At the end of the day, of course, the person with the deepest pockets wins, regardless of strategies.

The second thing I like about Jeff is that he was available to us even for small transactions. He does many at the same time — probably at least one a week for the whole year. Some of his customers are buying million-dollar homes, some apartments in the half-million range, and some large homes in the five-million range. He serves all of them. I never felt like he was underserving us.

Our Two Property Buys with Jeff

We worked with Jeff using two different pricing structures for two properties:

- Hunting for a unit/apartment. For the first property, my brother engaged him with the fee + commission structure. (Though my brother engaged him, we did all the work on his behalf, as he was abroad.) For the second, we used a pure fee structure.

- Hunting for a townhouse/house. For the second property, I personally engaged him to buy a townhouse or house. I paid him just the fee (no commission), which meant I was doing a lot of hunting.

It took us three weeks to buy the unit, and another three to buy the house. That’s two properties in six weeks.

Here’s how they went.

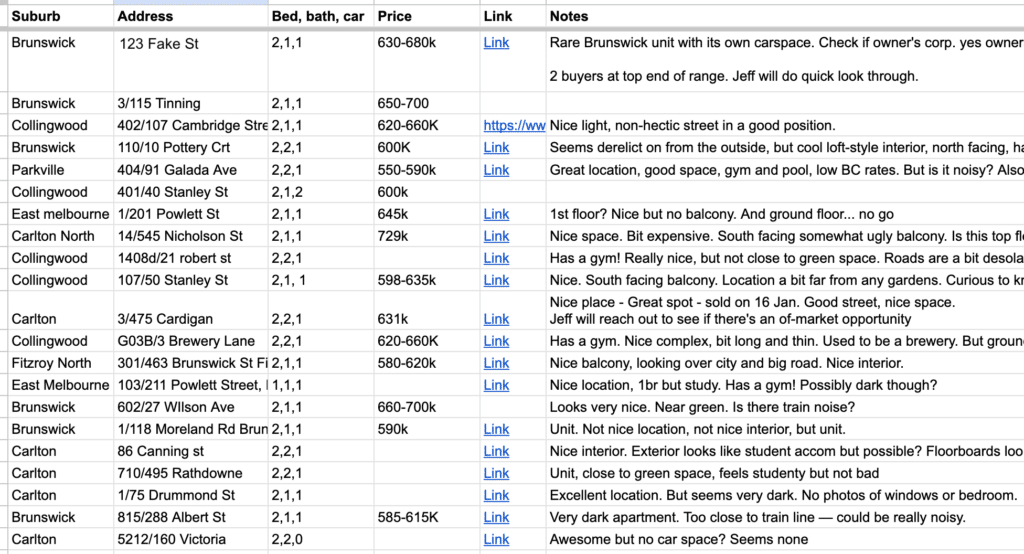

For the unit/apartment, Jeff first sent dozens (maybe a hundred) options. To be honest, this was pretty overwhelming, so I started organising a Google spreadsheet of everything.

We went through each apartment and developed a point of view of what we were after: rooms, bathrooms, parking garage. We had our own specific requirements, like a parking garage with a wall socket so we could charge a car. This was a significant limiting factor.

Eventually, we found a two-bedroom unit that we liked. In fact, I haven’t found one since! The stated range expected was $630-680K.

For the first purchase, we went to auction. In retrospect, I don’t think I want to ever do this again — at least, not when it’s not on my terms.

On the day there were just two other bidders. One was a person who was asking difficult questions, a middle-aged lady. The other was a young bloke we later saw at other auctions, too.

My heart was through the roof at the auction. This is normal — I even feel it when buying a car at auction, or when doing sniper bids on eBay! Anyway, I was very glad to have someone doing else doing the bidding on my behalf.

Before the auction, we agreed on a system. The auctioneer didn’t know who we were and our relationship with Jeff (something Jeff insisted on, so he could maintain control). We had a price ceiling up to which he’d bid. And after that, if I wanted him to keep bidding, I’d play with my phone.

Well, we didn’t even get up to the price ceiling. In fact, we were about $25K below it. Jeff bid fast and aggressively, erratically at times. There was only one other bidder in the end, and he just bid slowly up to what was his obvious ceiling. The lady didn’t even get to bid once — she seemed too intimidated by the pace of things. I don’t blame her!

So, for our first buy, we bought the very first place we were seriously interested in. It was a great buy, everyone agreed.

For our second buy, we had three contenders. One was in Brunswick, the second in Coburg, and the final place in Newport.

In Brunswick, there was a small house listed with a range of $1.05-1.15M. A free-standing house with a shared driveway.

It was really nice — north-facing, in a great location, and near a park. It lacked a few things I wanted (e.g. a porch or a garage), and it was a bit small with a total land area of around 230 m2, but location is king.

What Jeff did here was sound out the attention the house was getting. He was confident there were three to four other bidders and that the price would be over $1.2M. This was over the cap we set — so we never even went to the auction. And voilá, that’s exactly what happened — it sold for around $1.25. If we were bidding, it might have gone even higher.

The second house we were interested in was in Coburg, a semi-detached 3-bedroom home with an east-west aspect listed at $1.0-1.05M. We figured the lower range might mean it’d sell for within our budget.

For this house, we were also ready to go to auction. But a buyer put in an offer at the top of the range — not enough to trigger a sale, but enough for an early auction.

While we went to the auction, we were surprised to see people were so keen on the house that they paid more than they paid for the one in Brunswick (which had an obviously better location). This was a situation of overpaying, I thought. It sold for mid-$1.2M. Of course, it’ll hold its value.

Our final house — the one we ended up buying — was in Newport, a suburb we never were terribly interested in (its demographics don’t suit us, and it’s just not as cool a location as the inner north). But the house was cute and had everything we wanted — a garage (!), north-facing aspect, and just a really nice interior design.

For the Newport house, we decided to get aggressive with our strategy. We got the money organised, got an inspection done, and made an unconditional offer at a price we knew (thanks to Jeff) that the seller would accept — above the range, but below what we thought the house would cost.

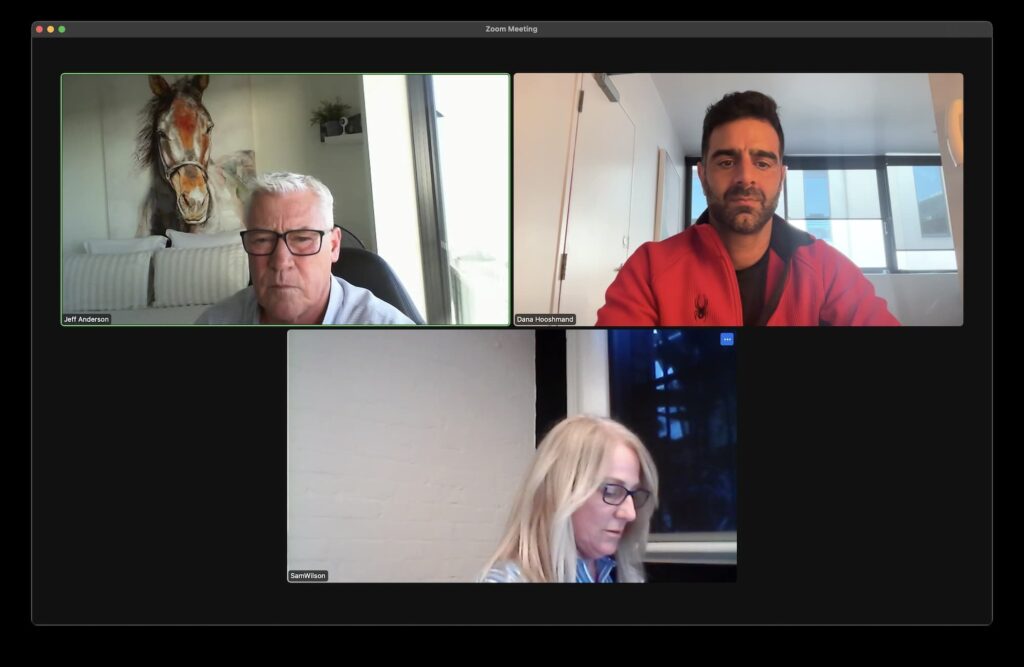

In Victoria, accepted offers are subject to a 3-day cooling off period. This filled us with stress! Then, it triggered an early auction. We heard there were two other bidders. The auction would be conducted by zoom and would start at our opening bid.

We thought we had the cards in our hand. We had made a very early offer, and we thought we’d have caught most people off-guard. The fact that there would be two other bidders was concerning.

In the end, there was only one other bidder. And that guy didn’t bid. He just showed up to the Zoom call to see what was going on. So — we got the house at our offer price. Unbelievable.

So our strategy worked! We made an early offer that was accepted and pushed others out of the race. Now, while I brought the money and the suggestion of the strategy, Jeff’s contribution was figuring out what price would be acceptable to both the seller and to us, and making sure our offer was the lowest it could be in that range. I’m pretty confident that if I had the same conversation, I would have paid at least $5K more — which means that even just in this Jeff earned his fees, and I saved $2K.

The total time it took to go through this whole process was six weeks for two properties. This is the other saving. I have time, but others don’t.

If you’ve spent countless weekends rushing to inspections and auctions, getting your hopes up only to be hopelessly outbid because you have no idea what the expected price is, then you may be able to see the benefit of a buyer’s agent.

People spend months looking for properties, all while the market keeps growing. We spent weeks. And in the months since buying our properties, we haven’t found a single one that we’d have bought over ours.

When you pay Jeff just a fee structure, you’re expected to do your own legwork. In other words, you’re expected to find the properties

Takeaways / Wrap-up

It’s hard to find a good buyer’s agent. Jeff worked for us twice, and I’m sure he would again. Even if you don’t go with Jeff (e.g. if you’re not from Melbourne), then the above should at least give you confidence that there are a few good ones out there.

- * Unrelated but important: Where’s the apostrophe in buyer’s/buyers’ agent? Is it buyers’ agent, i.e., acting for all potential buyers, or buyer’s agent, acting for me? Or should we omit it altogether? People don’t agree, which is why they’re all correct. I’m picking “buyer’s agent”, as he was my agent! ↩︎