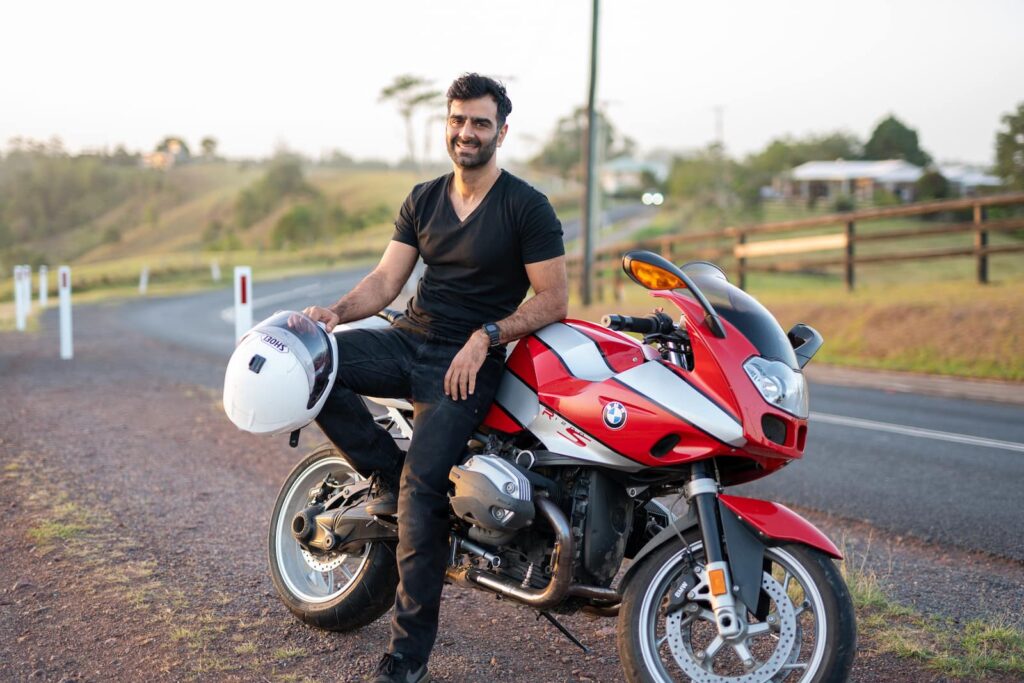

I’m Dana Hooshmand, the last human on the internet.

I’m based in Australia but travel for more than half the year, working remotely as I work on my online businesses and do consulting for a few special clients. Everywhere I go, I learn about language and culture, practise combat sports, ride and work on motorcycles, and do whatever else seems fun.

See more on my about page. And if you’re a kindred spirit, say hello!